F-1: Registration statement for securities of certain foreign private issuers

Published on November 14, 2019

As filed with the Securities and Exchange Commission on November 14, 2019

Registration No. 333-

UNITED STATES SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_______________

BETTERWARE DE MÉXICO, S.A. DE C.V.

(Exact name of registrant as specified in its charter)

_______________

|

Mexico |

5961 |

N/A |

||

|

(State or other jurisdiction of |

(Primary Standard Industrial |

(I.R.S. Employer |

Luis Enrique Williams 549

Colonia Belenes Norte

Zapopan, Jalisco, 45145, México

+52 (33) 3836-0500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

_______________

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, DE 19711

(302) 738-6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_______________

Copies to:

|

Alan I. Annex, Esq. |

Carol B. Stubblefield Esq. |

_______________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. £

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company S

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. £

____________

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered |

Proposed Maximum |

Amount of |

||||

|

Ordinary Shares, no par value per share(2) |

$ |

47,250,000 |

$ |

6,133.05 |

||

|

Total |

$ |

47,250,000 |

$ |

6,133.05 |

||

____________

(1) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, as amended (the “Securities Act”).

(2) Pursuant to Rule 416(a) of the Securities Act, there are also being registered an indeterminable number of additional securities as may be issued to prevent dilution resulting from share splits, share capitalizations and similar transactions.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. The registrant may not sell the securities described herein until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell the securities described herein and it is not soliciting an offer to buy the securities described herein in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION, DATED NOVEMBER 14, 2019 |

4,500,000 Ordinary Shares

BETTERWARE DE MÉXICO, S.A. DE C.V.

We are offering up to 4,500,000 ordinary shares, no par value per share. We expect the public offering price will be between $10.00 and $10.50 per share in a direct offering. There is no minimum number of shares that must be sold by us to proceed. We will retain the proceeds from the sale of any of the offered shares. The shares to be sold by us will be sold on our behalf by Andres Campos, our chief executive officer, on a best efforts basis. Mr. Campos will not receive any commission on proceeds from the sale of our ordinary shares on our behalf. See “Plan of Distribution.”

The offering is expected close simultaneously with the closing of the merger of DD3 Acquisition Corp. (“DD3”) and Betterware contemplated by that certain Combination and Stock Purchase Agreement, dated as of August 2, 2019, by and among DD3, Campalier, S.A. de C.V., a Mexican sociedad anónima de capital variable, Promotora Forteza, S.A. de C.V., a Mexican sociedad anónima de capital variable, Strevo, S.A. de C.V., a Mexican sociedad anónima de capital variable, Betterware, BLSM Latino América Servicios, S.A. de C.V., a Mexican sociedad anónima de capital variable, and, solely for the purposes set forth in Article XI of the Agreement, DD3 Mex Acquisition Corp, S.A. de C.V., a Mexican sociedad anónima de capital variable.

There is presently no public market for our ordinary shares. We have applied to have our ordinary shares listed on the Nasdaq Capital Market under the symbol “BTWM”. No assurance can be given that our application will be approved.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

We are an “emerging growth company” as that term is defined in the Jumpstart Our Business Startups Act of 2012 and, as such, will be subject to reduced public company reporting requirements.

Investing in our ordinary shares involves risks. See “Risk Factors” beginning on page 26 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities described herein or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

|

Per Share |

Total |

|||

|

Offering price |

||||

|

Proceeds, before expenses, to us |

Delivery of the securities will be made on or about December , 2019.

Prospectus dated .

Table of Contents

|

1 |

||

|

1 |

||

|

2 |

||

|

5 |

||

|

12 |

||

|

SELECTED HISTORICAL COMBINED FINANCIAL DATA OF BETTERWARE AND BLSM |

13 |

|

|

20 |

||

|

21 |

||

|

23 |

||

|

24 |

||

|

26 |

||

|

47 |

||

|

48 |

||

|

49 |

||

|

50 |

||

|

74 |

||

|

88 |

||

|

89 |

||

|

BETTERWARE MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

106 |

|

|

118 |

||

|

DD3 MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

128 |

|

|

131 |

||

|

134 |

||

|

138 |

||

|

140 |

||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

142 |

|

|

144 |

||

|

145 |

||

|

146 |

||

|

146 |

||

|

146 |

||

|

146 |

||

|

147 |

||

|

F-1 |

You should rely only on the information contained in this prospectus and any free-writing prospectus we prepare or authorize. We have not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

For investors outside the United States: we have not done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus or any free writing prospectus must inform themselves about, and observe any restrictions relating to, the offering of the ordinary shares and the distribution of this prospectus and any free writing prospectus outside the United States.

i

CONVENTIONS WHICH APPLY TO THIS PROSPECTUS

In this prospectus, unless otherwise specified or the context otherwise requires:

• “$,” “US$” and “U.S. dollar” each refer to the United States dollar; and

• “MX$,” “Ps.” and “peso” each refer to the Mexican peso.

In this prospectus, we rely on and refer to information and statistics regarding the direct selling industry and our competitors from market research reports and other publicly available sources. We have supplemented such information where necessary with our own internal estimates and information obtained from discussions with our customers, taking into account publicly available information about other industry participants and our management’s best view as to information that is not publicly available. While we believe that all such information is reliable, we have not independently verified industry and market data from third party sources. In addition, while we believe that our internal company research is reliable and the definitions of our industry and market are appropriate, neither our research nor these definitions have been verified by any independent source. Further, while we believe the market opportunity information included in this prospectus is generally reliable, such information is inherently imprecise. Projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us. See the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

1

Unless otherwise stated or unless the context otherwise requires, the term “DD3” refers to DD3 Acquisition Corp., the terms “we,” “us,” “our,” “Company,” “Betterware,” “BTW,” “BWM” and “BW” refer to Betterware de México, S.A. de C.V., and the term “combined company” refers to DD3 and Betterware together following the consummation of the Business Combination.

In this document, unless the context otherwise requires:

“Amended and Restated Charter” means the bylaws (estatutos sociales) to be adopted by the combined company in connection with the Closing.

“Amendment Agreement” means the Amendment Agreement to the Combination and Stock Purchase Agreement, dated as of September 23, 2019, by and among DD3, the Sellers, Betterware, BLSM and DD3 Mexico.

“Betterware Shares” means the share capital of Betterware.

“BLSM” means BLSM Latino América Servicios, S.A. de C.V.

“Business Combination” means the transactions contemplated by the Business Combination Agreement.

“Business Combination Agreement” means the Combination and Stock Purchase Agreement, dated as of August 2, 2019, as amended, and as may be further amended, by and among DD3, the Sellers, Betterware, BLSM and, solely for the purposes of Article XI therein, DD3 Mexico.

“Business Combination Proposal” means the proposal to be voted on at the special meeting to approve and adopt the Business Combination Agreement, and the transactions contemplated thereby, and the Business Combination.

“Closing” means the closing of the Business Combination.

“Code” means the U.S. Internal Revenue Code of 1986, as amended.

“combined company shares” means the ordinary shares, no par value, of the combined company.

“Companies Act” means the BVI Business Companies Act, 2004.

“DD3 Capital” means DD3 Capital Partners, S.A. de C.V.

“DD3 Mexico” means DD3 Mex Acquisition Corp, S.A. de C.V.

“EarlyBirdCapital” means EarlyBirdCapital, Inc.

“EBITDA” means Earnings Before Interest Taxes Depreciation and Amortization and is a non-GAAP financial measure.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“founder shares” means the ordinary shares issued prior to DD3’s initial public offering.

“General Corporations Law” means Ley General de Sociedades Mercantiles.

“IFRS” means International Financial Reporting Standards as issued by the International Accounting Standards Board.

“Incentive Plan” means the proposed incentive compensation plan that Betterware expects to adopt prior to the Closing.

“initial shareholders” means the holders of the founder shares prior to DD3’s initial public offering and their permitted transferees, as applicable.

“Insolvency Act” means the Insolvency Act, 2003 of the British Virgin Islands.

2

“Interim Charter” means the bylaws (estatutos sociales) to be adopted by DD3 upon the Redomiciliation taking effect.

“Investment Company Act” means the Investment Company Act of 1940, as amended.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012, as amended.

“Lock-Up Agreements” means, collectively, the Management Lock-Up Agreement and the Member Lock-Up Agreement.

“Management Lock-Up Agreement” means the Management Lock-Up Agreement to be entered into by certain members of the combined company’s management team in connection with, and as a condition to the consummation of, the Business Combination.

“Marcum” means Marcum LLP, an independent registered public accounting firm.

“Member Lock-Up Agreement” means the Member Lock-Up Agreement to be entered into by certain persons and entities who will hold combined company shares upon consummation of the Merger in connection with, and as a condition to the consummation of, the Business Combination.

“Merger” means the merger of DD3 with and into Betterware, with Betterware surviving such merger as the combined company and BLSM becoming a wholly-owned subsidiary of the combined company.

“Merger Agreement” means the Merger Agreement to be entered into by and between Betterware and DD3 in connection with, and as a condition to the consummation of, the Business Combination.

“Mexico” means the United Mexican States.

“Nasdaq” means the Nasdaq Stock Market LLC.

“ordinary shares” means the ordinary shares, no par value, of DD3.

“PCAOB” means the Public Company Accounting Oversight Board.

“private shares” means the ordinary shares sold as part of the private units.

“private units” means the units sold to the sponsor in private placements in connection with DD3’s initial public offering.

“private warrants” means the warrants underlying the private units, each of which is exercisable for one ordinary share, in accordance with its terms.

“Proxy Statement/Prospectus” means the proxy statement/prospectus included in the registration statement on Form F-4 (Registration No. 333-233982), as amended, filed with the SEC.

“Public Registry of Commerce” means the Registro Público de la Propiedad y del Comercio or Mexico’s federal public registry of commercial entities.

“public shareholders” means the holders of public shares.

“public shares” means the ordinary shares issued as part of the units sold in DD3’s initial public offering.

“public warrants” means the warrants included in the units sold in DD3’s initial public offering, each of which is exercisable for one ordinary share, in accordance with its terms.

“Redomiciliation” means the proposed redomiciliation of DD3 out of the British Virgin Islands to continue as a company incorporated under the laws of Mexico in connection with the Business Combination.

“Registrar” means the Registrar of Corporate Affairs in the British Virgin Islands.

“Registration Rights Agreement” means the Registration Rights Agreement to be entered into by and among DD3, Betterware and certain persons and entities that will receive combined company securities in exchange for

3

certain existing securities of DD3 and Betterware upon consummation of the Merger in connection with, and as a condition to the consummation of, the Business Combination.

“representative’s shares” means the shares issued in connection with DD3’s initial public offering to EarlyBirdCapital, as representative of the several underwriters.

“SEC” means the U.S. Securities Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Securities Market Law” means Ley del Mercado de Valores.

“Sellers” means, collectively, Campalier, S.A. de C.V., Promotora Forteza, S.A. de C.V., and Strevo, S.A. de C.V.

“special meeting” means the special meeting of shareholders of DD3.

“sponsor” means DD3 Mexico.

“Third Party Effective Date” means the registration date of the Merger Agreement before the applicable Public Registries.

“trust account” means the trust account that holds a portion of the proceeds of DD3’s initial public offering and the concurrent sale of the private units.

“U.S. GAAP” means United States generally accepted accounting principles.

“units” means the units issued in connection with DD3’s initial public offering, each of which consisted of one ordinary share and one warrant.

“warrants” means the public warrants and the private warrants.

4

This summary highlights certain information appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in our ordinary shares and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our ordinary shares, you should read the entire prospectus carefully, including “Risk Factors” and the financial statements and related notes included in this prospectus.

The Parties to the Business Combination

DD3

DD3 is a blank check company incorporated in the British Virgin Islands on July 23, 2018 formed for the purpose of effecting a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization or similar business combination with one or more businesses or entities.

DD3’s units, ordinary shares and warrants are currently listed on Nasdaq under the symbols “DDMXU,” “DDMX” and “DDMXW,” respectively. Any outstanding units will be separated into ordinary shares and warrants to purchase ordinary shares of the combined company upon the consummation of the Business Combination. We have applied to list the combined company shares and warrants on Nasdaq under the symbols “BTWM” and “BTWMW,” respectively. We cannot assure you that the combined company shares and warrants will be approved for listing on Nasdaq.

The mailing address of DD3’s principal executive office is:

DD3 Acquisition Corp.

c/o DD3 Mex Acquisition Corp

Pedregal 24, 4th Floor

Colonia Molino del Rey, Del. Miguel Hidalgo

11040 Mexico City, Mexico

Telephone: +52 (55) 8647-0417

For more information about DD3, see the sections entitled “Information About DD3” and “DD3 Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

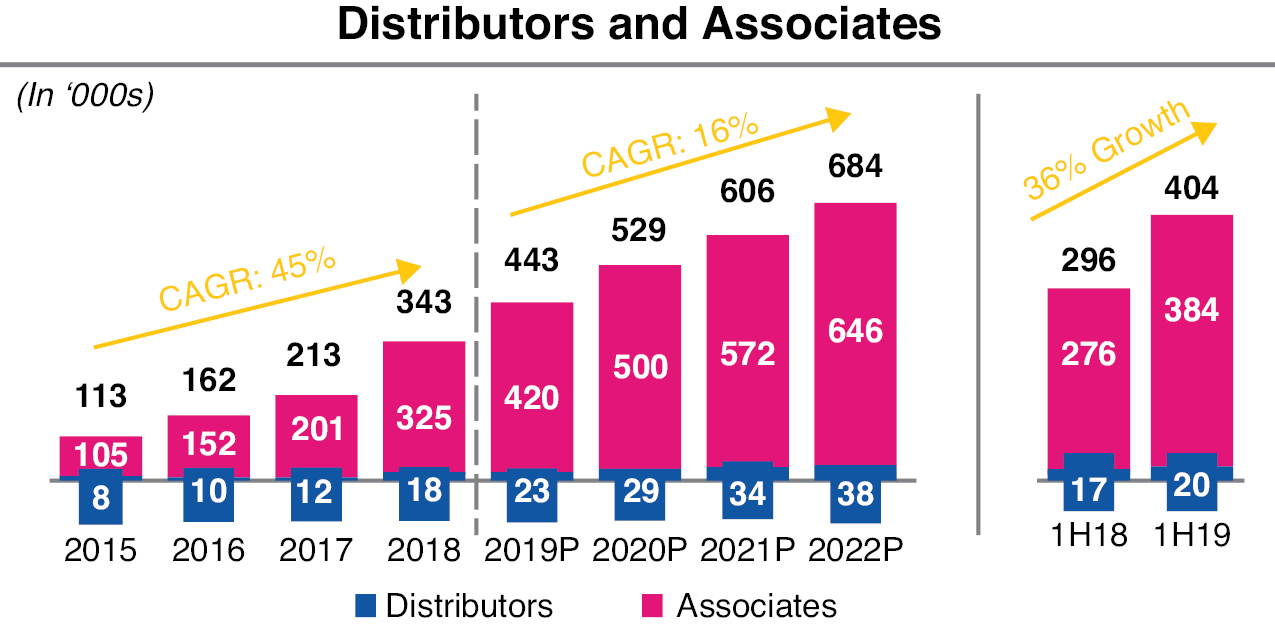

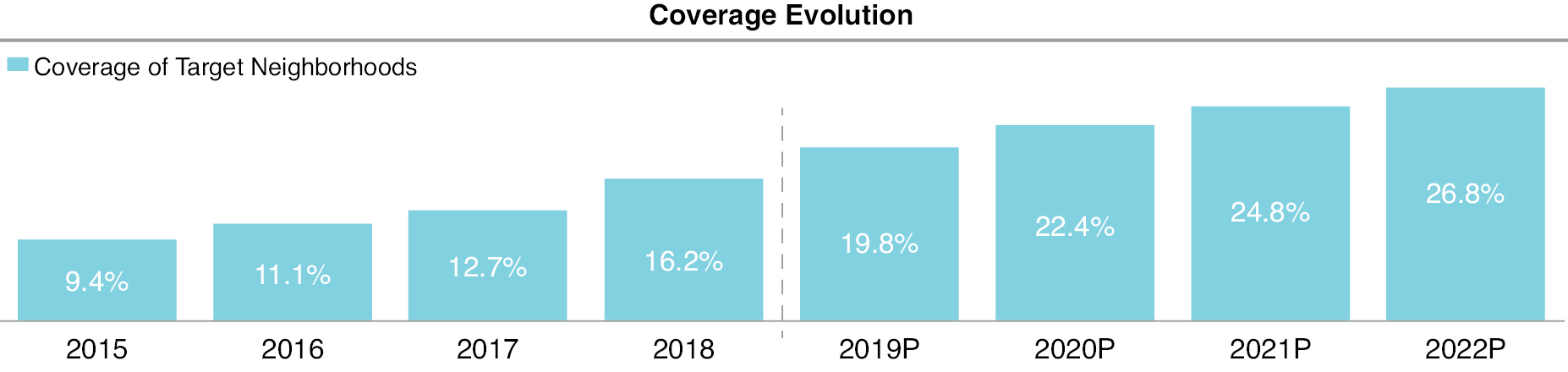

Betterware

Founded in 1995, Betterware is a leading direct-to-consumer company in Mexico. Betterware is focused on the home organization segment, with a wide product portfolio for daily solutions, including home organization, kitchen preparation, food containers, smart furniture, technology and mobility, as well as other minor categories. Supported by its unique business intelligence and data analytics unit, Betterware has been able to achieve sustainable double-digit growth rates by successfully expanding its market penetration through a dynamic and motivated sales force comprised of more than 400,000 distributors and associates. In addition, both the business intelligence and data analytics unit provide daily monitoring of key metrics and product intelligence. Due to its meticulous logistics planning through the supply chain, Betterware has achieved a 98.5% rate of just-in-time deliveries anywhere in the country, within 24 to 48 hours and with zero last mile cost. Its asset light model also has enabled Betterware to grow at a double-digit rate with very limited capex and high cash conversion rates.

BLSM is a Mexican company with the sole purpose of providing administrative, technical and operating services to Betterware. BLSM employs all of Betterware’s employees, and after the Business Combination, BLSM will be a wholly-owned subsidiary of Betterware.

The mailing address of Betterware’s principal executive office is:

Betterware de México, S.A. de C.V.

Luis Enrique Williams 549

Colonia Belenes Norte

Zapopan, Jalisco, 45145, México

Telephone: +52 (33) 3836-0500

5

For more information about Betterware, see the sections entitled “Information About Betterware” and “Betterware Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The Business Combination (Page 50)

The Business Combination Agreement provides for the Business Combination in which DD3 will purchase certain shares from the Sellers and thereafter merge with and into Betterware, with Betterware surviving the Merger as the combined company and BLSM becoming a wholly-owned subsidiary of the combined company, pursuant to the Merger Agreement to be executed at the Closing. For more information about the Business Combination, see the sections entitled “The Business Combination,” “The Business Combination Agreement” and “Certain Agreements Related to the Business Combination” beginning on pages 50, 74 and 88, respectively.

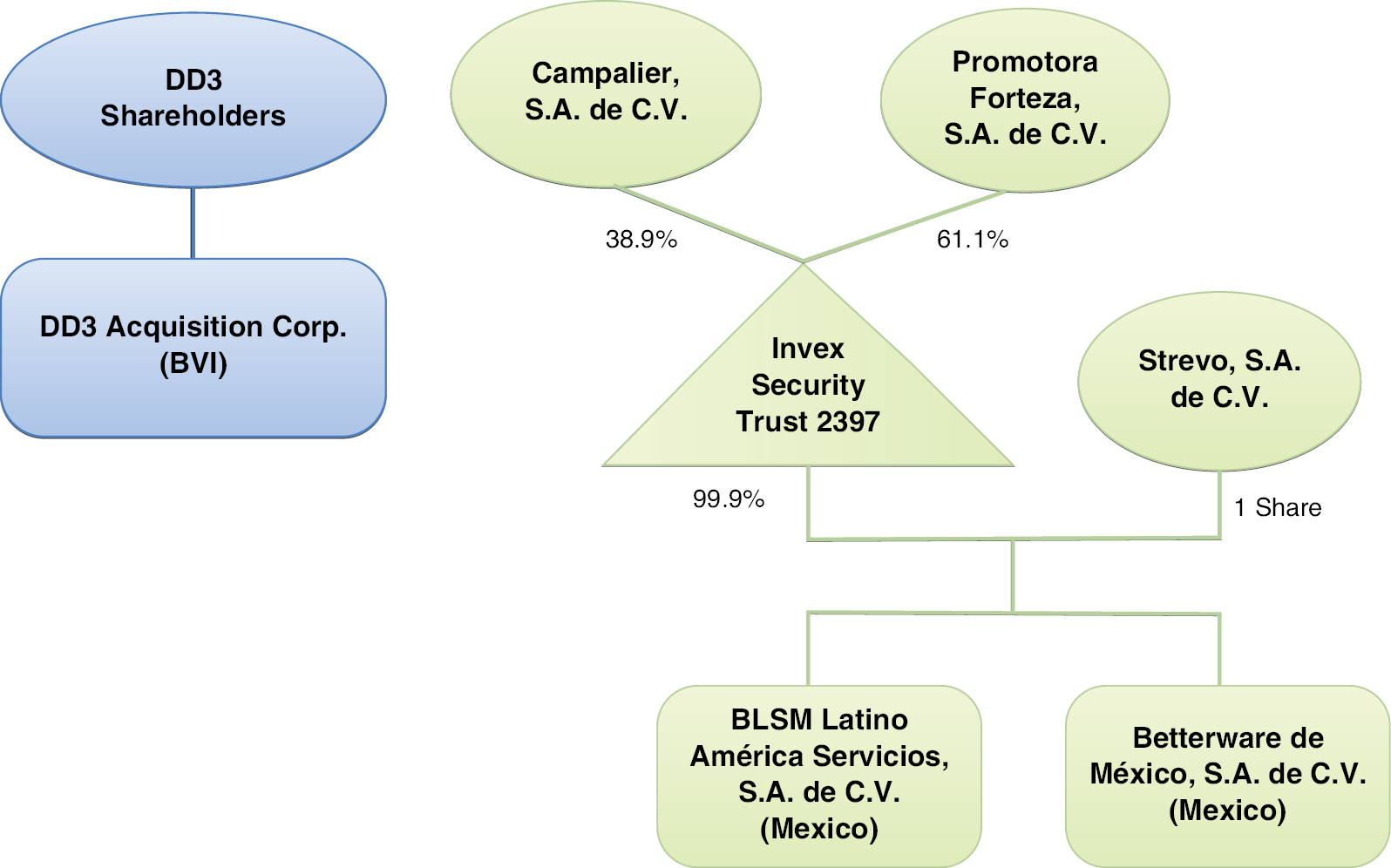

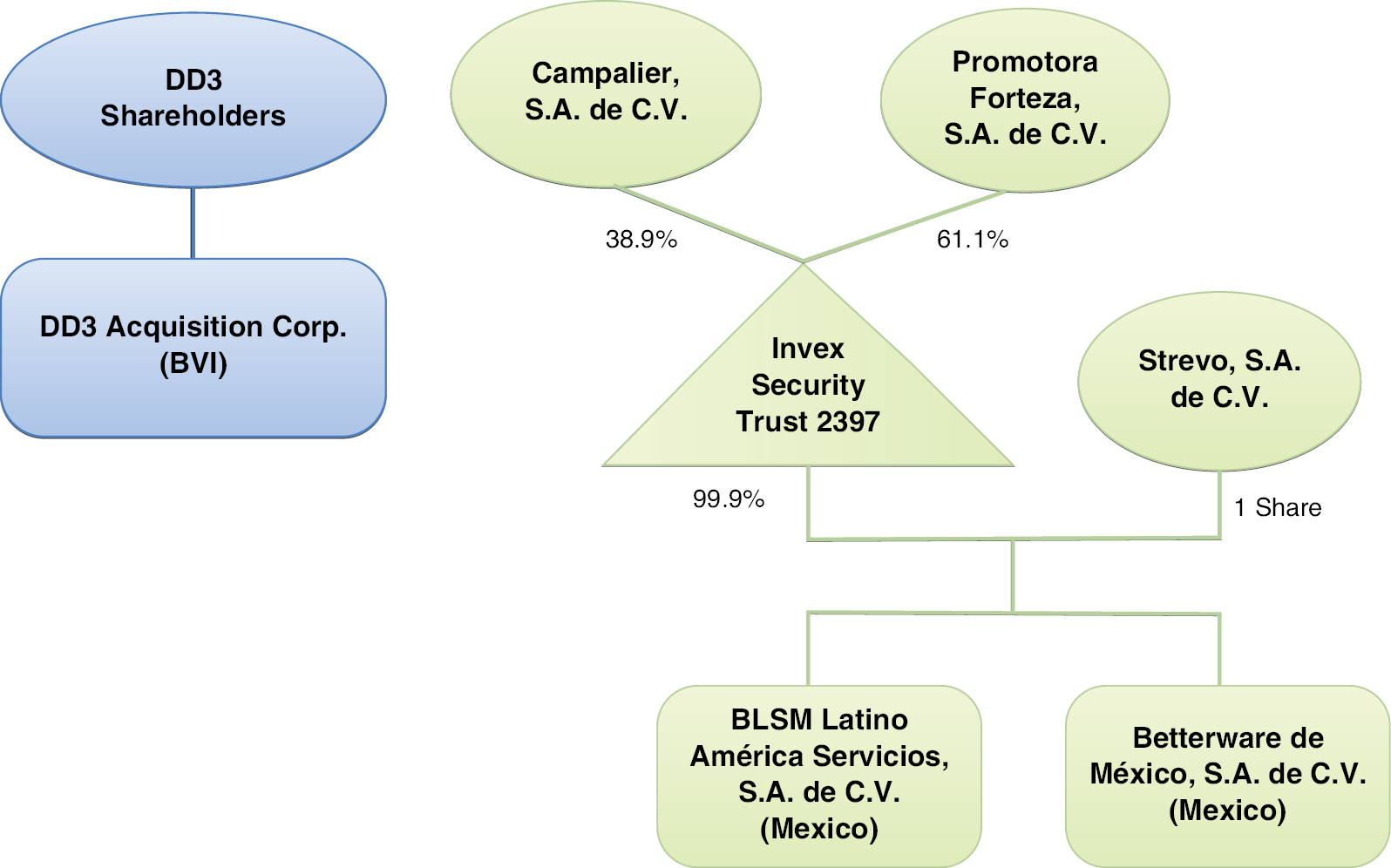

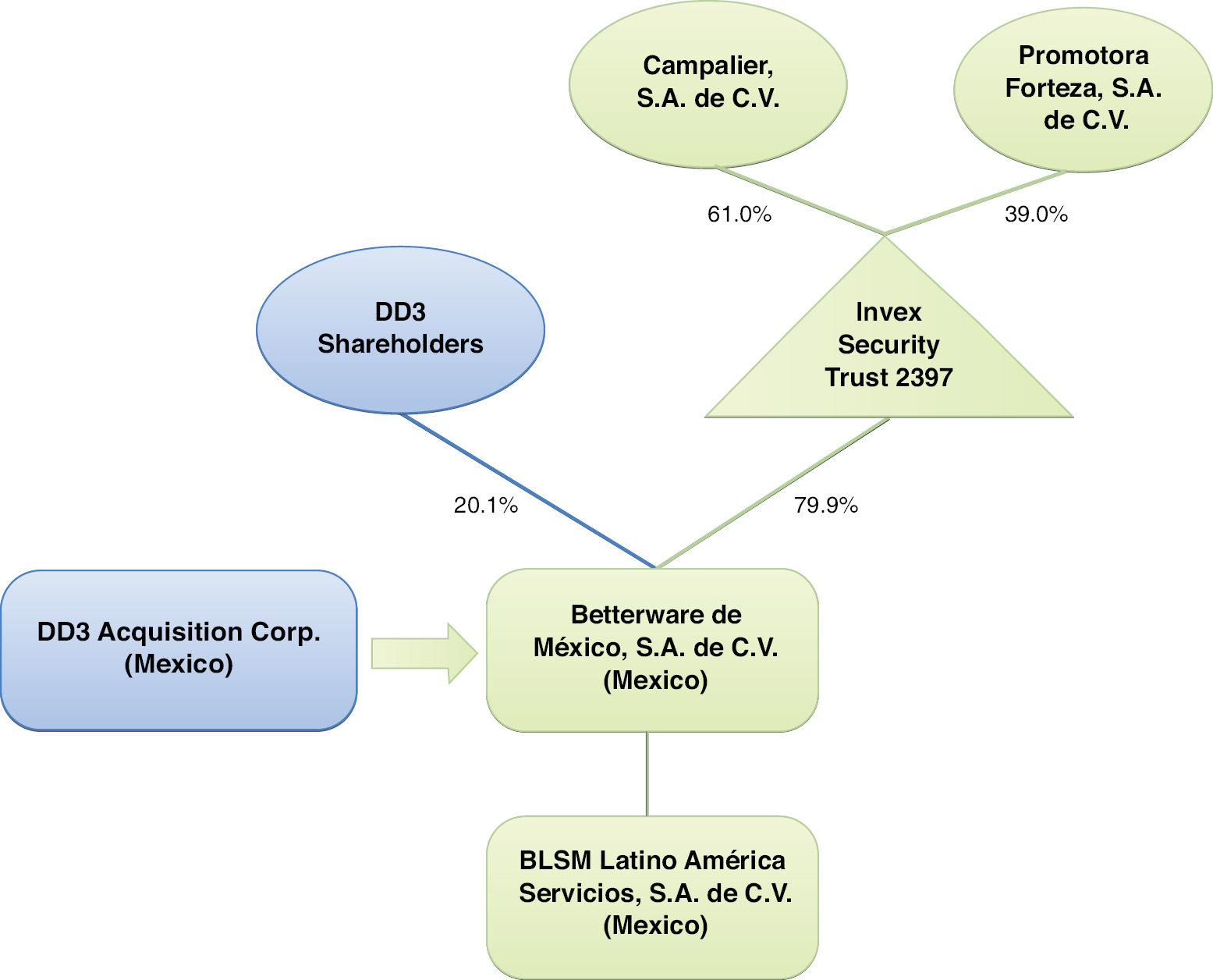

The following diagram depicts the organizational structure of DD3, Betterware and BLSM immediately prior to the consummation of the Business Combination:

6

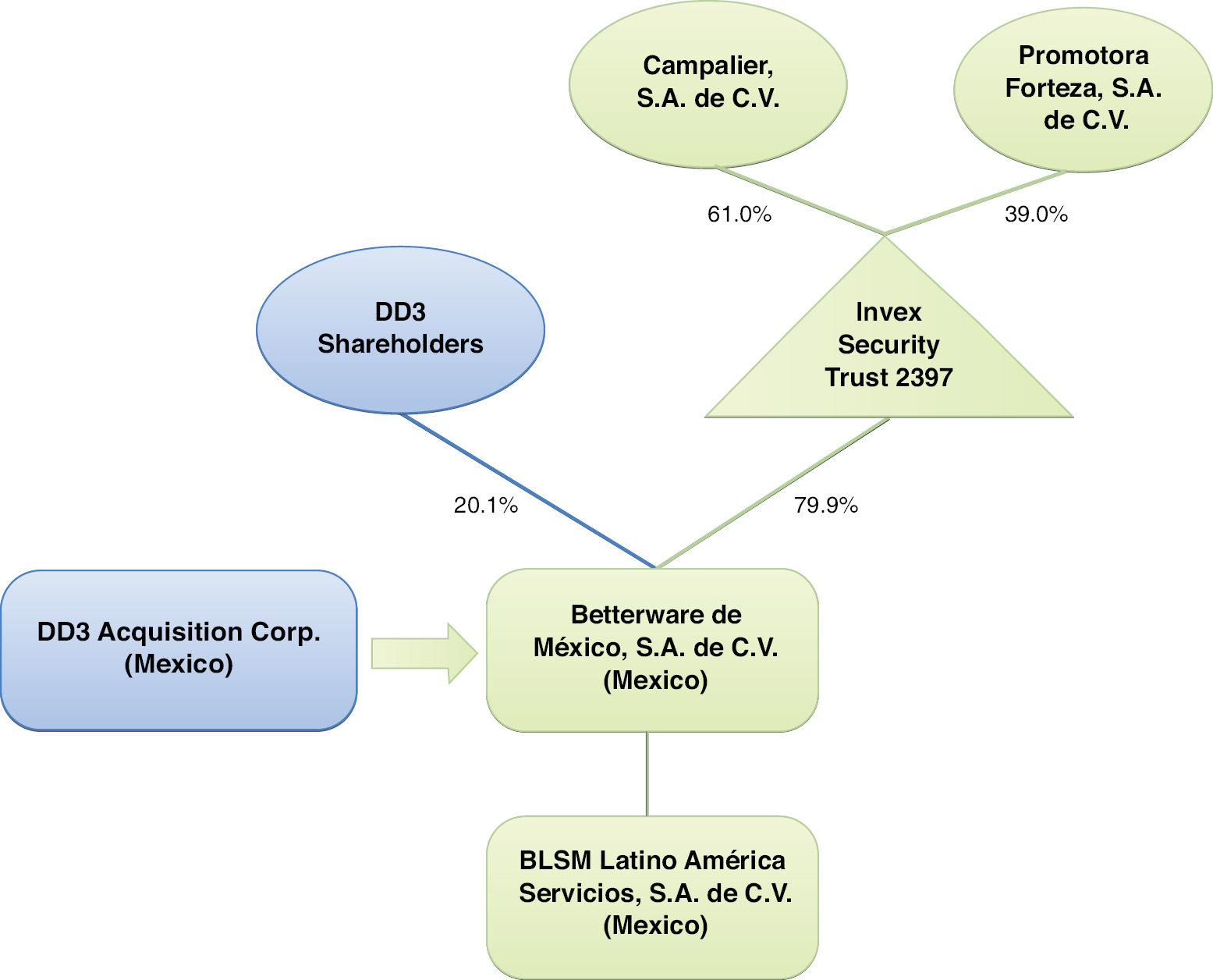

The following diagram depicts the organizational structure of the combined company immediately after the consummation of the Business Combination:

Consideration to Be Received in the Business Combination (Page 78)

The Business Combination Agreement provides that, at the effective time of the Merger pursuant to the Merger Agreement:

(i) DD3 will pay to the Sellers the amount, if any, by which the amount in the trust account as of the Closing exceeds $25,000,000 up to a maximum of $30,000,000;

(ii) all of the Betterware Shares issued and outstanding immediately prior to the effective time of the Merger will be canceled and to the extent the Sellers receive $30,000,000 in cash consideration from the trust account, the Sellers will be entitled to receive 28,700,000 combined company shares, or if the Sellers receive less than $30,000,000 in cash consideration, the Sellers will be entitled to receive the number of combined company shares equal to the combined valuation of Betterware and BLSM (as calculated pursuant to the Business Combination Agreement) less the cash consideration amount received by the Sellers, divided by $10.00; provided, however, that a portion of such combined company shares will be held in trust to secure debt obligations of the combined company, which will represent all of the combined company shares received by the Sellers; and

(iii) all of DD3’s ordinary shares issued and outstanding immediately prior to the effective time of the Merger will be canceled and exchanged for combined company shares on a one-for-one basis.

Ownership of the Combined Company Upon Completion of the Business Combination (Page 78)

Each of DD3’s outstanding warrants will, as a result of the Business Combination, cease to represent a right to acquire DD3 ordinary shares and will instead represent the right to acquire the same number of combined company shares, at the same exercise price and on the same terms as in effect immediately prior to the Closing. Similarly, the outstanding unit purchase option will cease to represent a right to acquire units of DD3 and will instead represent the right to acquire the same number of combined company shares and warrants underlying such units, at the same exercise price and on the same terms as in effect immediately prior to the Closing.

7

It is anticipated that, upon completion of the Business Combination, DD3’s existing shareholders will own, directly or indirectly, approximately 20% of the issued and outstanding combined company shares and Betterware’s existing shareholders will own, directly or indirectly, approximately 80% of the issued and outstanding combined company shares. These percentages are calculated based on a number of assumptions and are subject to adjustment in accordance with the terms of the Business Combination Agreement. These relative percentages assume (i) that none of DD3’s existing public shareholders exercise their redemption rights, (ii) DD3 does not issue any additional ordinary shares prior to the closing of the Business Combination and (iii) the Sellers are entitled to receive 28,700,000 combined company shares upon consummation of the Business Combination. These percentages do not include any exercise or conversion of the outstanding warrants and the unit purchase option that will, by their terms, convert automatically upon consummation of the Business Combination to entitle the holders to purchase an aggregate of 6,054,125 combined company shares and warrants to purchase an aggregate of 250,000 combined company shares. If any of DD3’s existing public shareholders exercise redemption rights, or any of the other assumptions are not true, these percentages will be different. You should read “The Business Combination Agreement — Ownership of the Combined Company Upon Completion of the Business Combination” and “The Business Combination — Unaudited Combined Pro Forma Financial Information” for further information.

The following table illustrates two different redemption scenarios based on the assumptions described above: (1) no redemptions, which assumes that none of the holders of DD3 ordinary shares exercise their redemption rights and the Sellers receive $30 million in cash consideration; and (2) minimum cash, in which DD3 has, in the aggregate, not less than $25 million of cash available for distribution upon the consummation of the Business Combination after redemptions of 3,106,457 ordinary shares, satisfying the condition to closing under the Business Combination Agreement:

|

No Redemptions |

Minimum Cash |

|||||||||

|

Number |

Percentage |

Number |

Percentage |

|||||||

|

DD3’s existing shareholders |

7,223,200 |

20.1 |

% |

4,116,743 |

11.5 |

% |

||||

|

Betterware’s existing shareholders |

28,700,000 |

79.9 |

% |

31,700,000 |

88.5 |

% |

||||

Redemption Rights (Page 119)

Pursuant to DD3’s amended and restated memorandum and articles of association, any holders of public shares may demand that such shares be redeemed in exchange for a pro rata share of the aggregate amount on deposit in the trust account (net of taxes payable), calculated as of two business days prior to the consummation of the Business Combination. Holders of public shares are not required to vote on any of the proposals to be presented at the special meeting in order to demand redemption of their public shares. If demand is properly made and the Business Combination is consummated, these shares, immediately prior to the Business Combination, will cease to be outstanding and will represent only the right to receive a pro rata share of the aggregate amount on deposit in the trust account which holds the proceeds of DD3’s initial public offering as of two business days prior to the consummation of the Business Combination (net of taxes payable), upon the consummation of the Business Combination. For illustrative purposes, based on funds in the trust account of approximately $56.6 million on June 30, 2019, the estimated per share redemption price would have been approximately $10.17. See the sections entitled “Information About DD3 — Redemption Rights” and “— Submission of the Business Combination to a Shareholder Vote” for more information about the redemption procedures in connection with the Business Combination.

Description of Combined Company Securities (Page 138)

Betterware is a company incorporated under the General Corporations Law. As Betterware is a Mexican corporation, immediately after the consummation of the Business Combination the rights of holders of combined company shares will be governed directly by Mexican law and the Amended and Restated Charter.

The Amended and Restated Charter will provide that the combined company will be authorized to issue an unlimited number of combined company shares. As of immediately after the consummation of the Business Combination, the combined company will have 35,923,200 combined company shares authorized and, based on the assumptions set out elsewhere in this prospectus, up to 35,923,200 combined company shares outstanding. See “Description of Combined Company Securities” for more information about the combined company’s securities.

8

Management After the Business Combination (Page 134)

Upon the effective time of the Merger, it is expected that Betterware’s current management team will remain operating the business:

|

Name |

Title |

|

|

Luis Campos |

Chairman |

|

|

Andres Campos |

Chief Executive Officer |

|

|

Jose del Monte |

Chief Financial Officer |

|

|

Fabian Rivera |

Chief Operating Officer |

Regulatory Approvals Required for the Business Combination (Page 57)

DD3 and Betterware are not aware of any regulatory approvals in either Mexico or the United States required for the consummation of the Business Combination.

Accounting Treatment (Page 57)

The Business Combination will be accounted for as a “reverse merger” in accordance with IFRS. Under this method of accounting, DD3 will be treated as the “acquired” company for financial reporting purposes. This determination was primarily based on the assumption that Betterware’s shareholders will hold a majority of the voting power of the combined company, Betterware’s operations comprising the ongoing operations of the combined company, Betterware’s designees comprising a majority of the governing body of the combined company, and Betterware’s senior management comprising the senior management of the combined company. Accordingly, for accounting purposes, the Business Combination will be treated as the equivalent of Betterware issuing shares for the net assets of DD3, accompanied by a recapitalization. The net assets of DD3 will be stated at historical cost, with no goodwill or other intangible assets recorded. Operations prior to the Business Combination will be deemed to be those of Betterware.

Certain U.S. Federal Income Tax Considerations (Page 64)

Subject to the limitations and qualifications described in “The Business Combination — Certain U.S. Federal Income Tax Considerations — U.S. Federal Income Tax Consequences of the Business Combination to U.S. Holders of DD3 Ordinary Shares — Receipt of Combined Company Shares by Holders of DD3 Ordinary Shares or Warrants,” the receipt of combined company shares in the Business Combination should be a taxable transaction for U.S. federal income tax purposes. As a result, a U.S. holder of shares of DD3 ordinary shares or warrants, as applicable, should recognize capital gain or loss for U.S. federal income tax purposes in an amount equal to the difference, if any, between (1) the fair market value at the time of the receipt of combined company shares, and (2) the U.S. holder’s adjusted tax basis in such DD3 ordinary shares or warrants, as applicable. If a U.S. holder acquired different blocks of DD3 ordinary shares or warrants at different times or different prices, such U.S. holder must determine its tax basis and holding period separately with respect to each block of DD3 ordinary shares or warrants, as applicable. Such gain or loss will be long-term capital gain or loss provided that a U.S. holder’s holding period for such shares or warrants is more than one year at the date of the Merger. Subject to the discussion under “— Passive Foreign Investment Company Status,” long-term capital gains recognized by U.S. holders that are not corporations generally are eligible for reduced rates of federal income taxation. The deductibility of capital losses is subject to certain limitations. A U.S. holder should have a tax basis in combined company shares received equal to their fair market value on the date of the Merger, and the U.S. holder’s holding period with respect to combined company shares should begin on the day after the date of the Merger.

For a more detailed discussion of certain U.S. federal income tax considerations of the Business Combination, see “The Business Combination — Certain U.S. Federal Income Tax Considerations.” You are strongly urged to consult your tax advisor for a full understanding of the tax consequences of the Business Combination to you, including the applicability and effect of federal, state, local and non-U.S. income and other tax laws.

DD3’s Board of Directors’ Reasons for the Approval of the Business Combination (Page 53)

DD3’s board of directors, in evaluating the Business Combination, consulted with DD3’s management and legal and financial advisors. In reaching its unanimous resolution (i) that the terms and conditions of the Business

9

Combination Agreement, including the proposed Business Combination, are advisable, fair to, and in the best interests of DD3 and its shareholders and (ii) to recommend that shareholders adopt and approve the Business Combination Agreement and approve the Business Combination contemplated therein, DD3’s board of directors considered a range of factors, including but not limited to, the factors discussed below. In light of the number and wide variety of factors, DD3’s board of directors did not consider it practicable to and did not attempt to quantify or otherwise assign relative weights to the specific factors it considered in reaching its determination. DD3’s board of directors viewed its position as being based on all of the information available and the factors presented to and considered by it. In addition, individual directors may have given different weight to different factors.

In approving the Business Combination, DD3’s board of directors determined not to obtain a fairness opinion. The officers and directors of DD3, including Dr. Werner and Mr. Combe, have substantial experience in evaluating the operating and financial merits of companies from a wide range of industries and concluded that their experience and backgrounds, together with the experience and sector expertise of DD3’s financial advisors, including EarlyBirdCapital, enabled them to make the necessary analyses and determinations regarding the Business Combination with Betterware. In addition, DD3’s officers and directors and DD3’s advisors have substantial experience with mergers and acquisitions.

In considering the Business Combination, DD3’s board of directors gave considerable weight to the following factors:

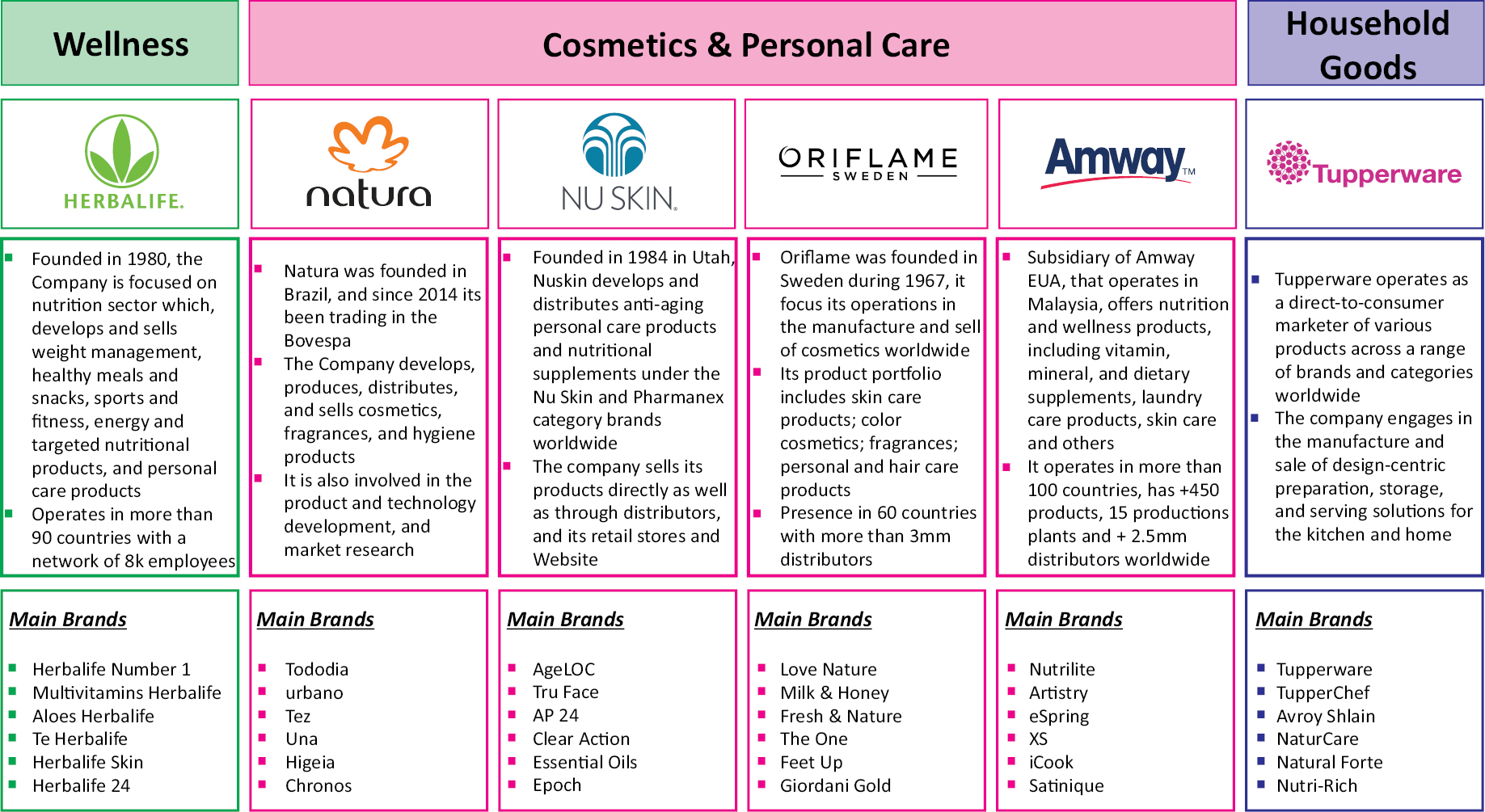

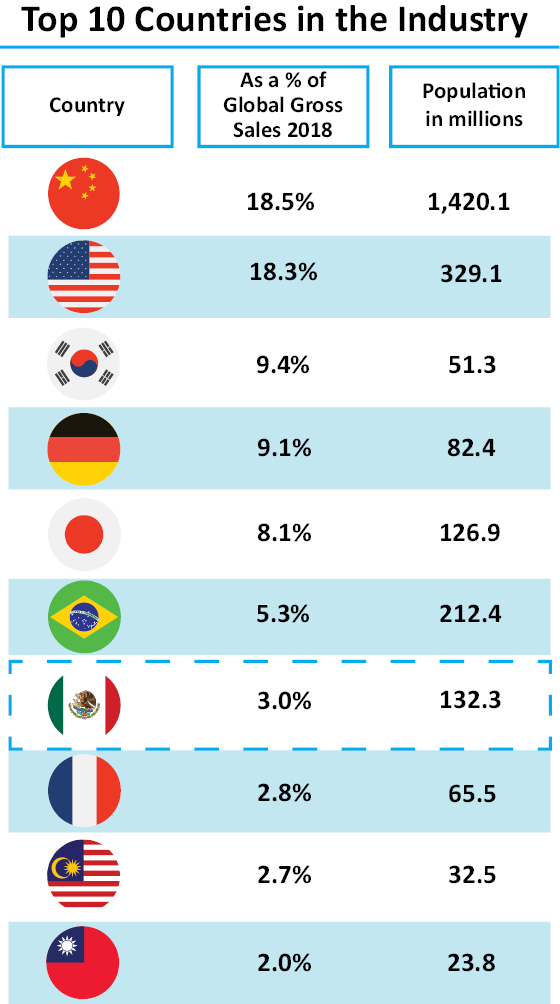

• Attractive Market and Favorable Industry Trends. According to the World Federation of Direct Selling Associations, or the WFDSA, Mexico is the seventh largest direct-to-consumer market in the world and the second largest in Latin America, with US$6bn of annual sales in 2018, and has been growing at a 2.3% CAGR from 2015 to 2018. In 2018 year-end, consumer confidence index in Mexico reached its highest level since 2006;

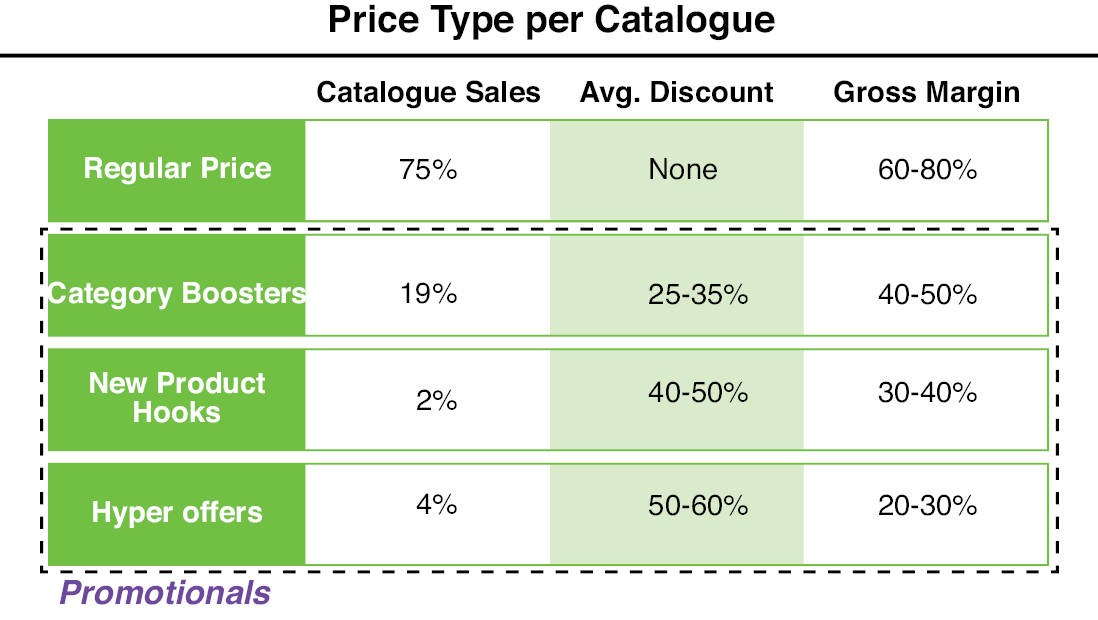

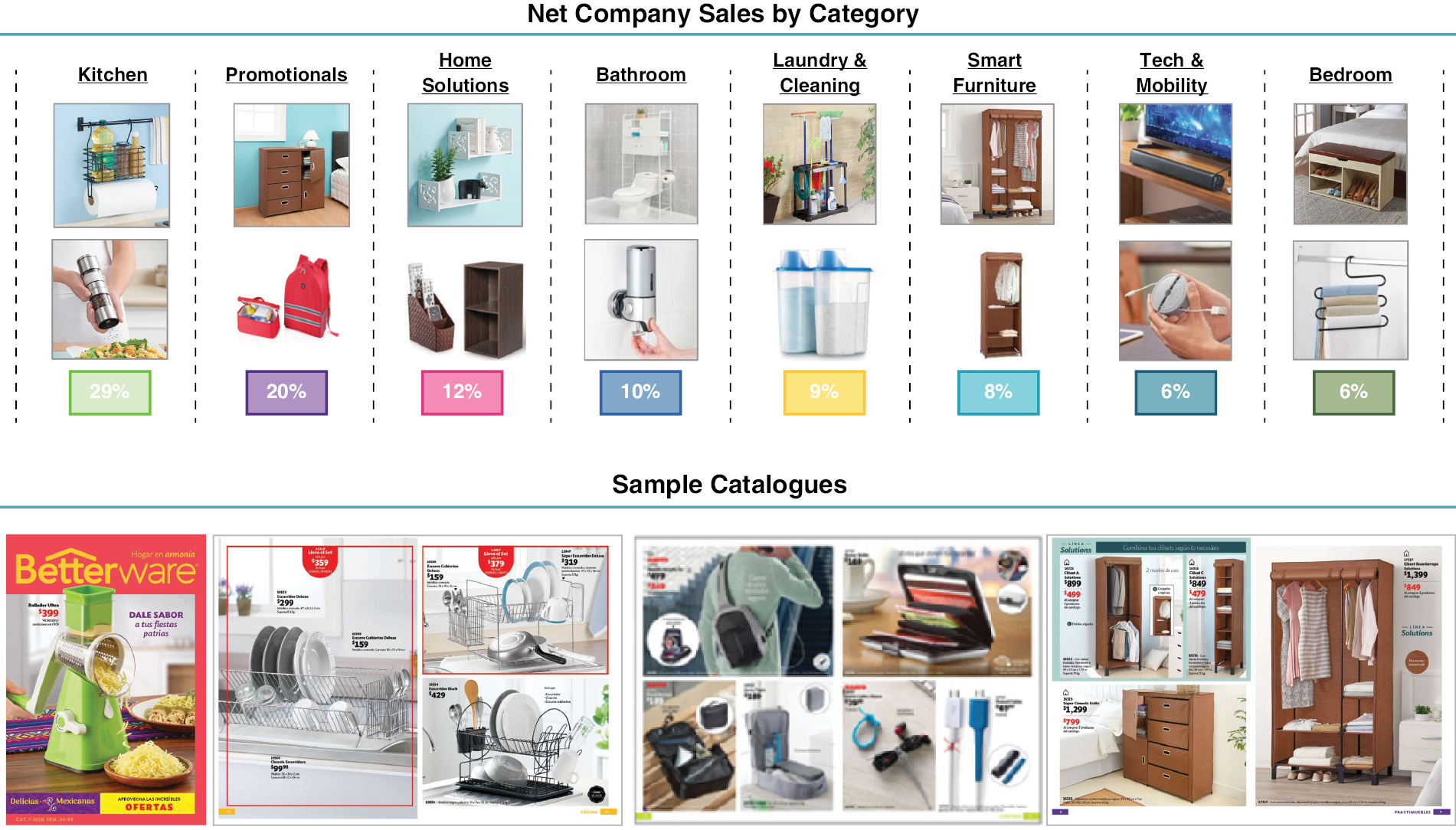

• Leader in its Sector in Mexico. Betterware is a direct-to-consumer company focused in the home organization segment. Betterware sells its products through nine catalogues published throughout the year (approximately 6 weeks outstanding each) with an offer of approximately 400 products per catalogue at approximately US$5.50 average price;

• Proven Business Model Backed by Technological Disruption. Supported by its unique business intelligence and data analytics unit, Betterware has shown long-term sustainable double-digit growth rates in revenue and EBITDA and has successfully built platforms that can grow locally and in other regions;

• Unparalleled Logistics Platform. Due to its meticulous logistics planning through the supply chain, Betterware has achieved a 99.9% service level and a 98.5% rate of deliveries on time anywhere in the country within 24 to 48 hours at a zero last mile cost, with its Distributors and Associates delivering the products to the final consumers;

• Unique Product Portfolio. Betterware sells its products through nine catalogues published throughout the year (approximately 6 weeks outstanding each) with an offer of approximately 400 products per catalogue at approximately US$5.50 average price. Betterware constantly innovates introducing approximately 300 products every year, representing 10% – 15% of the products in a catalogue;

• Robust Distribution Platform. Betterware sells its products through a unique two-tier sales model that is comprised of more than 400,000 Distributors and Associates across Mexico that serve +3 million households every six weeks in +800 communities;

• Clear Multiple Additional Sources of Growth. Betterware has identified multiple additional sources of growth that could expand and enhance Betterware’s platform. Some of the additional sources of growth include E-commerce app implementation, international expansion and strategic acquisitions;

• Commitment and Experience of Management. Betterware’s management team has over 30 years of experience in the direct-to-consumer sector and is expected to continue to run the business post transaction. Betterware’s management will rollover 91% of its equity, showing long-term commitment to Betterware;

10

• Attractive Valuation. The purchase price values Betterware at a discount versus selected comparable companies on a pro forma implied total enterprise value as a multiple of Betterware’s 2019E EBITDA;

• Optimally Sized Transaction. Upon consummation of the Business Combination, DD3’s existing shareholders will own, directly or indirectly, approximately 20% of the issued and outstanding combined company shares and Betterware’s existing shareholders will own, directly or indirectly, approximately 80% of the issued and outstanding combined company shares (subject to the assumptions described elsewhere in this prospectus); and

• Highly Complementary Management Teams. Dr. Werner, DD3’s Chairman and Chief Executive Officer, will join the board of directors of the combined company. His experience in the financial sector will be highly complementary to the skills and experience of the strong management team of Betterware.

DD3’s board of directors also considered a variety of uncertainties and risks and other potentially negative factors concerning the Business Combination, including, but not limited to, the following:

• Macroeconomic Risks. Macroeconomic uncertainty and the effects it could have on the combined company’s revenues;

• Benefits May Not Be Achieved. The risk that the potential benefits of the Business Combination may not be fully achieved or may not be achieved within the expected timeframe;

• Financial Projections May Not be Achieved. The risk that the cost savings and growth initiatives may not be fully achieved or may not be achieved within the expected timeframe;

• No Third-Party Valuation. The risk that DD3 did not obtain a third-party valuation or fairness opinion in connection with the Business Combination;

• DD3’s Shareholders Receiving a Minority Position in Betterware. The risk that DD3’s shareholders will hold a minority share position in the combined company, or approximately 20% of the issued and outstanding combined company shares (subject to the assumptions described elsewhere in this prospectus); and

• Other Risks. Various other risks associated with the business of Betterware, as described in the section entitled “Risk Factors” appearing elsewhere in this prospectus.

DD3’s board of directors concluded that the potential benefits that it expected Betterware and its shareholders to achieve as a result of the Business Combination outweighed the potentially negative factors associated with the Business Combination. DD3’s board of directors also noted that DD3’s shareholders would have a substantial economic interest in the combined company (depending on the level of DD3’s shareholders that sought redemption of their public shares into cash). Accordingly, DD3’s board of directors unanimously determined that the Business Combination Agreement and the Business Combination contemplated therein, were advisable, fair to, and in the best interests of DD3 and its shareholders.

11

|

Ordinary Shares Offered |

4,500,000 shares at per share |

|

|

Ordinary Shares to be Outstanding Immediately Following this Offering |

40,423,200 shares |

|

|

Use of Proceeds |

We estimate that the net proceeds from the sale of our ordinary shares in this offering will be approximately $ , after deducting estimated transactional expenses payable by us. We intend to use the net proceeds for general corporate purposes following the consummation of the Business Combination. |

|

|

Market for our Ordinary Shares |

We have applied to have our ordinary shares listed on the Nasdaq Capital Market under the symbol “BTWM”. No assurance can be given that our application will be approved. |

|

|

Risk Factors |

Investing in our ordinary shares involves substantial risks. See “Risk Factors” for a description of certain of the risks you should consider before investing in our ordinary shares. |

The number of ordinary shares to be outstanding immediately after this offering is based on Betterware issuing the maximum number of ordinary shares in connection with the Business Combination, or 35,923,200 ordinary shares.

12

SELECTED HISTORICAL COMBINED FINANCIAL DATA OF BETTERWARE AND BLSM

The financial information presented in this section is derived from and should be read in conjunction with the combined financial statements of Betterware and their accompanying notes, appearing elsewhere in this document and with the section entitled “Betterware Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The combined financial statements of Betterware and BLSM have been prepared in accordance with IFRS as issued by the International Accounting Standards Board. These are the first financial statements prepared by Betterware under IFRS, the date of transition to IFRS is January 1, 2017.

Annual Financial Information

The selected historical financial information presented below has been derived from and should be read in conjunction with Betterware’s financial statements and their accompanying notes included elsewhere in this prospectus. Such annual financial information, unless otherwise specified, is presented in nominal pesos.

Selected Balance Sheet Data as of December 31, 2018, 2017 and January 1, 2017

(In thousands of Mexican pesos “Ps.”)

|

2018 |

2017 |

January 1, |

||||

|

Assets |

||||||

|

Current assets: |

||||||

|

Cash and cash equivalents |

Ps. 177,383 |

230,855 |

206,186 |

|||

|

Trade accounts receivable, net |

198,776 |

147,933 |

119,172 |

|||

|

Inventory, net |

302,206 |

141,894 |

107,087 |

|||

|

Other current assets |

51,486 |

39,269 |

46,215 |

|||

|

Total current assets |

729,851 |

559,951 |

478,660 |

|||

|

Trade accounts receivable from related parties, long-term |

— |

— |

586,174 |

|||

|

Molds, equipment and leasehold improvements, net |

42,972 |

57,162 |

46,955 |

|||

|

Intangible assets |

312,099 |

300,471 |

1,860 |

|||

|

Goodwill |

348,441 |

348,441 |

25,805 |

|||

|

Other non-current assets |

24,236 |

21,417 |

17,460 |

|||

|

Total non-current assets |

727,748 |

727,491 |

678,254 |

|||

|

Ps. 1,457,598 |

1,287,442 |

1,156,914 |

13

Selected Balance Sheet Data as of December 31, 2018, 2017 and January 1, 2017

(In thousands of Mexican pesos “Ps.”)

|

2018 |

2017 |

January 1, |

||||

|

Liabilities and Net Parent Investment |

||||||

|

Current Liabilities: |

||||||

|

Borrowings |

Ps. 90,691 |

46,218 |

67,325 |

|||

|

Accounts payable to suppliers |

445,241 |

211,071 |

141,432 |

|||

|

Other current liabilities |

198,512 |

180,009 |

82,624 |

|||

|

Total current liabilities |

734,444 |

437,298 |

291,381 |

|||

|

Non-current Liabilities: |

||||||

|

Deferred Income tax |

70,627 |

78,922 |

— |

|||

|

Borrowings |

562,788 |

591,162 |

805,896 |

|||

|

Other non-current liabilities |

9,475 |

1,283 |

935 |

|||

|

Total non-current liabilities |

642,890 |

671,367 |

806,831 |

|||

|

Total liabilities |

1,377,334 |

1,108,665 |

1,098,212 |

|||

|

Net parent investment |

80,264 |

178,777 |

58,702 |

|||

|

Ps. 1,457,598 |

1,287,442 |

1,156,914 |

14

Selected Statement of Profit or Loss Data for the years ended December 31, 2018 and 2017

(In thousands of Mexican pesos “Ps.”)

|

2018 |

2017 |

|||||

|

Net revenue |

Ps. 2,316,716 |

|

1,449,705 |

|

||

|

Cost of sales |

958,469 |

|

558,105 |

|

||

|

Gross profit |

1,358,247 |

|

891,600 |

|

||

|

Administrative Expenses |

249,148 |

|

204,555 |

|

||

|

Selling Expenses |

454,016 |

|

291,834 |

|

||

|

Distribution Expenses |

103,336 |

|

64,349 |

|

||

|

Operating income |

551,747 |

|

330,862 |

|

||

|

Financing cost, net |

(102,301 |

) |

(26,237 |

) |

||

|

Profit before income taxes |

449,446 |

|

304,625 |

|

||

|

Total income taxes |

150,179 |

|

96,951 |

|

||

|

Profit for the year |

Ps. 299,267 |

|

207,674 |

|

||

|

|

|

|||||

|

Per Share Data: |

|

|

||||

|

Weighted average shares outstanding – basic and diluted |

8,306,841 |

|

|

|||

|

Basic and diluted net (loss) income per share |

36.03 |

|

|

|||

|

Cash dividends declared per share |

Ps. 36.12 |

|

|

|||

15

Interim Financial Information as of June 30, 2019 and 2018 and for the six months then ended

Selected Balance Sheet Data as of June 30, 2019 and December 31, 2018

(In thousands of Mexican Pesos “Ps.”)

|

June 30, |

December 31, 2018 |

|||

|

Assets |

||||

|

Current assets: |

||||

|

Cash and cash equivalents |

Ps. 96,920 |

177,383 |

||

|

Trade accounts receivable, net |

296,230 |

198,776 |

||

|

Inventory, net |

351,632 |

302,206 |

||

|

Other current assets |

59,974 |

51,486 |

||

|

Total current assets |

804,756 |

729,851 |

||

|

Molds, equipment and leasehold improvements, net |

134,371 |

42,972 |

||

|

Intangible assets |

307,759 |

312,099 |

||

|

Goodwill |

348,441 |

348,441 |

||

|

Other assets |

35,323 |

24,236 |

||

|

Total non-current assets |

825,894 |

727,748 |

||

|

Ps. 1,630,650 |

1,457,598 |

16

Selected Balance Sheet Data as of June 30, 2019 and December 31, 2018

(In thousands of Mexican Pesos “Ps.”)

|

June 30, |

December 31, 2018 |

|||

|

Liabilities and Net Parent Investment |

||||

|

Current Liabilities: |

||||

|

Leases |

Ps. 9,137 |

— |

||

|

Borrowings |

182,094 |

90,691 |

||

|

Accounts payable to suppliers |

459,798 |

445,241 |

||

|

Other current liabilities |

153,045 |

198,512 |

||

|

Total current liabilities |

804,074 |

734,444 |

||

|

Non-current liabilities: |

||||

|

Deferred income tax |

73,306 |

70,627 |

||

|

Borrowings |

535,093 |

562,788 |

||

|

Other non-current liabilities |

31,048 |

9,475 |

||

|

Total non-current liabilities |

639,447 |

642,890 |

||

|

Total liabilities |

1,443,521 |

1,377,334 |

||

|

Net parent investment |

187,129 |

80,264 |

||

|

Ps. 1,630,650 |

1,457,598 |

17

Selected Statement of Profit or Loss Data for the six months ended June 30, 2019 and June 30, 2018

(In thousands of Mexican Pesos “Ps.”)

|

June 30, |

June 30, |

|||||

|

Net revenue |

Ps. 1,535,622 |

|

1,042,880 |

|

||

|

Cost of sales |

638,648 |

|

419,679 |

|

||

|

Gross profit |

896,974 |

|

623,201 |

|

||

|

Administrative Expenses |

169,856 |

|

106,136 |

|

||

|

Selling Expenses |

272,930 |

|

205,924 |

|

||

|

Distribution Expenses |

67,333 |

|

47,453 |

|

||

|

Operating income |

386,855 |

|

263,688 |

|

||

|

Financing cost, net |

(45,932 |

) |

(43,631 |

) |

||

|

Profit before income taxes |

340,923 |

|

220,057 |

|

||

|

Total income tax provision |

106,057 |

|

66,885 |

|

||

|

Profit for the year |

Ps. 234,866 |

|

153,172 |

|

||

|

Per Share Data: |

|

|

||||

|

Weighted average shares outstanding – basic and diluted |

8,697,317 |

|

|

|||

|

Basic and diluted net (loss) income per share |

27.00 |

|

|

|||

|

Cash dividends declared per share |

Ps. 14.72 |

|

|

|||

Non IFRS Financial Measures

We define “EBITDA” as profit for the year adding back the depreciation of property, plant and equipment, amortization of intangible assets, financing cost, net and income taxes. Adjusted EBITDA further excludes employee benefit expense, gain on sale of fixed assets, and other non-recurring expenses. EBITDA and Adjusted EBITDA are not measures required by, or presented in accordance with IFRS. The use of EBITDA and Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation from, or as a substitute for analysis of, our results of operations or financial condition as reported under IFRS.

DD3 and Betterware believe that these non-IFRS financial measures are useful to investors because (i) Betterware uses these measures to analyze its financial results internally and believes they represent a more transparent measure of operating profitability and (ii) these measures will serve investors to understand and evaluate Betterware’s EBITDA and provide more tools for their analysis as it makes Betterware’s results comparable to industry peers that also prepare these measures.

Betterware’s EBITDA Reconciliation

|

In thousands of Mexican Pesos |

2018 |

2017 |

|||

|

Profit for the year |

Ps. 299,267 |

|

207,274 |

||

|

Add: Total Income Taxes |

150,179 |

|

96,951 |

||

|

Add: Financing Cost, net |

102,301 |

|

26,237 |

||

|

Add: Depreciation and Amortization |

25,960 |

|

24,209 |

||

|

EBITDA |

Ps. 577,707 |

|

354,671 |

||

|

Other Adjustments |

|

||||

|

Less: Gain on Sale of Fixed Assets(1) |

(11,820 |

) |

|||

|

Add: Non-recurring Expenses(2) |

7,667 |

|

|||

|

Adjusted EBITDA |

Ps. 573,554 |

|

354,671 |

||

____________

(1) Unusual income for the sale of transportation equipment.

(2) Expenses incurred in the year including market penetration analysis, liquidation payment to former employees, licensing implementation of SAS software.

18

|

In thousands of Mexican Pesos |

June 30, |

June 30, |

||

|

Profit for the year |

Ps. 234,866 |

153,172 |

||

|

Add: Total Income Taxes |

106,057 |

66,885 |

||

|

Add: Financing Cost, net |

45,932 |

43,631 |

||

|

Add: Depreciation and Amortization |

13,963 |

14,098 |

||

|

EBITDA |

Ps. 400,818 |

277,786 |

||

|

Other Adjustments |

||||

|

Add: Non-recurring Expenses(1) |

4,469 |

494 |

||

|

Adjusted EBITDA |

Ps. 405,287 |

278,280 |

____________

(1) Unusual expenses mainly related to the transaction with DD3 for the six months ended June 30, 2019 and Betterware’s foundation for the six months ended June 30, 2018.

19

SELECTED HISTORICAL FINANCIAL AND OTHER DATA OF DD3

The following tables summarize the relevant financial data for DD3’s business and should be read in conjunction with the section entitled “DD3 Management’s Discussion and Analysis of Financial Condition and Results of Operations” and DD3’s audited financial statements, and the notes related thereto, which are included elsewhere in this prospectus.

DD3’s balance sheet data as of June 30, 2019 and statement of operations data for the period from July 23, 2018 (inception) through June 30, 2019 are derived from DD3’s audited financial statements included elsewhere in this prospectus.

The historical results presented below are not necessarily indicative of the results to be expected for any future period. You should read the following selected financial information in conjunction with DD3’s financial statements and related notes and the section entitled “DD3 Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained elsewhere in this prospectus.

(in thousands of U.S. Dollars, except share and per share data)

|

For the |

||||

|

Revenue |

$ |

— |

|

|

|

Loss from operations |

|

(711 |

) |

|

|

Interest income on marketable securities |

|

928 |

|

|

|

Unrealized gain on marketable securities |

|

10 |

|

|

|

Net income |

|

227 |

|

|

|

Basic and diluted net loss per share |

|

(0.33 |

) |

|

|

Weighted average shares outstanding – basic and diluted |

|

1,889,222 |

|

|

|

Balance Sheet Data: |

As of |

|||

|

Working capital deficit |

$ |

(235 |

) |

|

|

Trust account |

|

56,588 |

|

|

|

Total assets |

|

56,845 |

|

|

|

Total liabilities |

|

492 |

|

|

|

Value of ordinary shares subject to redemption |

|

51,353 |

|

|

|

Shareholders’ equity |

|

5,000 |

|

|

20

The following table sets forth the historical comparative share information for Betterware and DD3 on a stand-alone basis and pro forma combined per share information after giving effect to the Business Combination, (1) assuming no DD3 shareholders exercise redemption rights with respect to their ordinary shares upon the consummation of the Business Combination; and (2) assuming that DD3 shareholders exercise their redemption rights with respect to a maximum of 3,106,457 ordinary shares upon consummation of the Business Combination.

The combined financial statements of Betterware and BLSM historical financial statements of Betterware have been prepared in accordance with IFRS and in its functional and presentation currency of the Mexican Peso. The historical financial statements of DD3 have been prepared in accordance with U.S. GAAP in its functional and presentation currency of United States dollars. The financial statements of DD3 have been translated into Mexican Pesos for purposes of having pro forma combined financial information.

The historical information should be read in conjunction with the information in the sections entitled “Selected Historical Financial and Other Data of DD3” and “Selected Historical Combined Financial Data of Betterware and BLSM” and the historical financial statements of DD3 and Betterware incorporated by reference in or included elsewhere in this prospectus. The pro forma combined per share information is derived from, and should be read in conjunction with, the information contained in the section of this prospectus entitled “The Business Combination — Unaudited Combined Pro Forma Financial Information.”

The Betterware pro forma equivalent per share financial information is calculated by multiplying the combined unaudited pro forma per share amounts by the exchange ratio, whereby each Betterware ordinary share will be converted into the right to receive 5.70 DD3 ordinary shares assuming no redemptions under Scenario 1 or 6.29 DD3 ordinary shares assuming maximum redemptions.

The pro forma combined share information below does not purport to represent what the actual results of operations or the earnings per share would been had the companies been combined during the periods presented, nor to project the combined company’s results of operations or earnings per share for any future date or period. The pro forma combined shareholders’ equity per share information below does not purport to represent what the value of DD3 and Betterware would have been had the companies been combined during the periods presented.

(in Mexican pesos, in thousands, except share and per share data)

|

Betterware |

DD3 |

Pro Forma Combined Assuming No Redemptions into Cash |

Pro Forma Combined Assuming Maximum Redemptions into Cash |

||||||

|

Six Months Ended June 30, 2019 |

|

||||||||

|

Net income |

Ps 234,866 |

Ps 3,054 |

|

Ps 237,294 |

Ps 237,294 |

||||

|

Shareholders’ equity |

187,129 |

96,044 |

|

614,020 |

583,509 |

||||

|

Weighted average shares outstanding – basic and diluted |

8,697,317 |

1,889,222 |

|

35,923,200 |

35,816,743 |

||||

|

Basic and diluted net (loss) income per share |

27.00 |

(6.34 |

) |

6.61 |

6.63 |

||||

|

Basic and diluted net (loss) income equivalent per share |

— |

— |

|

37.66 |

41.72 |

||||

|

Book value per share – basic and diluted |

21.52 |

50.84 |

|

17.09 |

16.29 |

||||

|

Shareholders’ equity equivalent per share – basic and diluted |

— |

|

97.37 |

102.51 |

|||||

|

Cash dividends declared per share – basic and diluted |

14.72 |

— |

|

— |

— |

||||

21

|

Betterware |

DD3 |

Pro Forma Combined Assuming No Redemptions into Cash |

Pro Forma Combined Assuming Maximum Redemptions into Cash |

||||||

|

Year Ended December 31, 2018 (Betterware) and For the Period from July 23, 2018 (inception) Through March 31, 2019 (DD3) |

|

||||||||

|

Net income |

Ps 299,267 |

Ps 5,481 |

|

Ps 296,765 |

Ps 296,765 |

||||

|

Shareholders’ equity |

80,265 |

96,150 |

|

499,711 |

469,166 |

||||

|

Weighted average shares outstanding – basic and diluted |

8,306,841 |

1,799,651 |

|

35,923,200 |

35,816,743 |

||||

|

Basic and diluted net (loss) income per share |

36.03 |

(2.69 |

) |

8.26 |

8.29 |

||||

|

Basic and diluted net (loss) income equivalent per share |

— |

— |

|

47.06 |

52.16 |

||||

|

Book value per share – basic and diluted |

9.66 |

53.43 |

|

13.91 |

13.10 |

||||

|

Shareholders’ equity equivalent per share – basic and diluted |

— |

— |

|

79.25 |

82.42 |

||||

|

Cash dividends declared |

36.12 |

— |

|

— |

— |

||||

22

The following table sets out, for the periods indicated, high, low, average and period-end noon buying rates in the City of New York for cable transfers between the Mexican peso and the U.S. dollar, as determined for customs purposes by the Federal Reserve Bank of New York, expressed as pesos per US$1.00. The rates may differ from the actual rates used in the preparation of the combined Financial Statements and other financial information appearing in this prospectus. We make no representation that the peso or the U.S. dollar amounts referred to in this prospectus have been, could have been or could, in the future, be converted to U.S. dollars or pesos, as the case may be, at any particular rate, if at all. On June 30, 2019, the noon buying rate in the City of New York for cable transfers between peso and U.S. dollars as certified for customs purposes by the Federal Reserve Bank of New York was Ps19.2089 per US$1.00.

|

Year Ended December 31, |

High |

Low |

Average(1) |

Period End |

||||

|

2017 |

21.8910 |

17.4775 |

18.8841 |

19.6395 |

||||

|

2018 |

20.6700 |

17.9705 |

19.2179 |

19.6350 |

|

Month |

High |

Low |

Average(1) |

Period End |

||||

|

January 2019 |

19.6095 |

18.9275 |

19.1704 |

19.0525 |

||||

|

February 2019 |

19.4050 |

19.0405 |

19.1953 |

19.2650 |

||||

|

March 2019 |

19.5795 |

18.8550 |

19.2442 |

19.3980 |

||||

|

April 2019 |

19.2245 |

18.7555 |

18.9641 |

18.9945 |

||||

|

May 2019 |

19.6520 |

18.8515 |

19.1110 |

19.6520 |

||||

|

June 2019 |

19.7680 |

18.9905 |

19.2728 |

19.2089 |

||||

|

July 2019 |

19.2270 |

18.8940 |

19.0452 |

18.9930 |

||||

|

August 2019 |

20.1185 |

19.1700 |

19.6828 |

20.0674 |

||||

|

September 2019 |

19.9920 |

19.3480 |

19.5470 |

19.7420 |

23

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains a number of forward-looking statements, including statements about the financial conditions, results of operations, earnings outlook and prospects of DD3 and Betterware and may include statements for the period following the consummation of the Business Combination and the date of this prospectus. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of DD3 and Betterware, as applicable, and are inherently subject to uncertainties and changes in circumstance and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in “Risk Factors,” those discussed and identified in public filings made with the SEC by Betterware or DD3 and the following:

• the occurrence of any event, change or other circumstances that could give rise to the termination of the Business Combination Agreement;

• the outcome of any legal proceedings that may be instituted against DD3, Betterware and others following announcement of the proposed Business Combination and transactions contemplated thereby;

• the inability to complete the transactions contemplated by the proposed Business Combination due to the failure to obtain the approval of DD3’s shareholders or other conditions to closing in the Business Combination Agreement;

• the ability to obtain or maintain the listing of the combined company’s securities on Nasdaq following the Business Combination;

• the risk that the proposed Business Combination disrupts current plans and operations as a result of the announcement and consummation of the transactions described herein;

• the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition and the ability of the combined business to grow and manage growth profitably;

• costs related to the Business Combination;

• the limited liquidity and trading of DD3’s securities;

• geopolitical risk and changes in applicable laws or regulations;

• the inability to profitably expand into new markets;

• the possibility that DD3 or Betterware may be adversely affected by other economic, business and/ or competitive factors;

• financial performance;

• operational risk;

• litigation and regulatory enforcement risks, including the diversion of management time and attention and the additional costs and demands on Betterware’s resources;

• fluctuations in exchange rates between the Mexican peso and the United States dollar; and

• the risks that the Closing is substantially delayed or does not occur.

24

Should one or more of these risks or uncertainties materialize, or should any of the assumptions made by the management of DD3 and Betterware prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. All subsequent written and oral forward-looking statements concerning the Business Combination or other matters addressed in this prospectus and attributable to DD3 or Betterware or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this prospectus. Except to the extent required by applicable law or regulation, DD3 and Betterware undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

25

An investment in our ordinary shares carries a significant degree of risk. You should carefully consider the following risk factors, together with all of the other information included in this prospectus, before making a decision to invest in our ordinary shares. The risks described below are those which DD3 and Betterware believe are the material risks that they face. Additional risks not presently known to them or which they currently consider immaterial may also have an adverse effect on them or the combined company following the Business Combination. Some statements in this prospectus, including such statements in the following risk factors, constitute forward-looking statements. See the section entitled “Cautionary Note Regarding Forward-Looking Statements.” If any of the following events occur, our business, financial condition and operating results may be materially adversely affected. In that event, the trading price of our securities could decline, and you could lose all or part of your investment.

Risks Related to the Business of Betterware

Currency exchange rate fluctuations, particularly with respect to the US dollar/Mexican peso exchange rate, could lower margins.

The value of the Mexican peso has been subject to significant fluctuations with respect to the U.S. dollar in the past and may be subject to significant fluctuations in the future. Historically, BWM has been able to raise their prices generally in line with local inflation, thereby helping to mitigate the effects of devaluations of the Mexican peso. However, BWM may not be able to maintain this pricing policy in the future, or future exchange rate fluctuations may have a material adverse effect on its ability to pay its suppliers.

Given Betterware’s inability to predict the degree of exchange rate fluctuations, it cannot estimate the effect these fluctuations may have upon future reported results, product pricing or its overall financial condition. Although BWM attempts to reduce its exposure to short-term exchange rate fluctuations by using foreign currency exchange contracts, it cannot be certain that these contracts or any other hedging activity will effectively reduce exchange rate exposure. In particular, BTW currently employs a hedging strategy comprised of forwards U.S. dollar–Mexican peso derivatives that are designed to protect it against devaluations of the Mexican peso. As of this date, the hedging contracts cover 100% of the product needs as of March 2020. In addition, BWM generally purchases its hedging instruments on a rolling twelve-month basis; instruments protecting it to the same or a similar extent may not be available in the future on reasonable terms. Unprotected declines in the value of the Mexican peso against the U.S. dollar will adversely affect its ability to pay its dollar-denominated expenses, including its supplier obligations. See “Betterware Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Any adverse changes in BWM’s business operations in Mexico would adversely affect its revenue and profitability.

BWM’s revenue is generated in Mexico. Various factors could harm BWM’s business in Mexico. These factors include, among others:

• worsening economic conditions, including a prolonged recession in Mexico;

• fluctuations in currency exchange rates and inflation;

• longer collection cycles;

• potential adverse changes in tax laws;

• changes in labor conditions;

• burdens and costs of compliance with a variety of laws;

• political, social and economic instability; and

• increases in taxation

26

Mexico is an emerging market economy, with attendant risks to BWM’s results of operations and financial condition.

The Mexican government has exercised, and continues to exercise, significant influence over the Mexican economy. Accordingly, Mexican governmental actions concerning the economy and state-owned enterprises could have a significant impact on Mexican private sector entities in general, as well as on market conditions, prices and returns on Mexican securities. The national elections held on July 2, 2018 ended six years of rule by the Institutional Revolutionary Party or PRI with the election of President Andres Manuel Lopez Obrador, a member of the Morena Party, and resulted in the increased representation of opposition parties in the Mexican Congress and in mayoral and gubernatorial positions. Although there have not yet been any material adverse repercussions resulting from this political change, multiparty rule is still relatively new in Mexico and could result in economic or political conditions that could materially and adversely affect BWM’s operations. BWM cannot predict the impact that this new political landscape will have on the Mexican economy. Furthermore, BWM’s financial condition, results of operations and prospects and, consequently, the market price for its share, may be affected by currency fluctuations, inflation, interest rates, regulation, taxation, social instability and other political, social and economic developments in or affecting Mexico.

The Mexican economy in the past has suffered balance of payment deficits and shortages in foreign exchange reserves. There are currently no exchange controls in Mexico; however, Mexico has imposed foreign exchange controls in the past. Pursuant to the provisions of the United States-Mexico-Canada Agreement, if Mexico experiences serious balance of payment difficulties or the threat thereof in the future, Mexico would have the right to impose foreign exchange controls on investments made in Mexico, including those made by U.S. and Canadian investors.

Securities of companies in emerging market countries tend to be influenced by economic and market conditions in other emerging market countries. Emerging market countries, including Argentina and Venezuela, have recently been experiencing significant economic downturns and market volatility. These events could have adverse effects on the economic conditions and securities markets of other emerging market countries, including Mexico.

Mexico may experience high levels of inflation in the future, which could affect BWM’s results of operations.

During most of the 1980s and during the mid- and late-1990s, Mexico experienced periods of high levels of inflation, although the country has had stable inflation during the last five years. The annual rates of inflation for the last five years as measured by changes in the National Consumer Price Index, as provided by Banco de Mexico, were:

|

2018 |

4.8% |

|

|

2017 |

6.8% |

|

|

2016 |

3.4% |

|

|

2015 |

2.1% |

|

|

2014 |

4.1% |

A substantial increase in the Mexican inflation rate would have the effect of increasing some of BWM’s costs, which could adversely affect its results of operations and financial condition.

If Betterware is unable to retain its existing independent distributors and recruit additional distributors, its revenue increase could potentially slow down.